Introduction to Blockchain and Cryptocurrencies

A short intro

Cryptocurrencies have been hyped tremendously in media throughout the last year. Hitting a record high of more than $800 bn in January 2018 in overall market capitalization according to coinmarketcap.com, cryptocurrencies can be defined as a global phenomenon among others for “believers”, investors, day traders and companies that are looking into generating alternative income sources. While Bitcoin has undoubtedly evolved to become the most prominent cryptocurrency to date, it is far from the only “digital currency” in the world. In fact, data platform coinmarketcap.org reports a total of 1545 different cryptocurrencies as of February 19th, 2018 - the number still growing exponentially. Technology news are dominated by headlines such as: “Bitcoin reaches $19k”, “Ethereum breaks $1k” and “Ripple founder is now richer than Google founders on paper”. It is easy to see, that cryptocurrencies are creating a market for new, emerging companies (e.g. Ethereum, Ripple, etc.). At the same time, traditional companies are starting to look into the concept: “Mark Zuckerberg is officially considering cryptocurrency for Facebook”, “Kodak is getting into Bitcoin mining” and “Biggest ICO Ever: Telegram raises $850 M for its TON Blockchain project”.

Figure 1: Development of crypto market cap in USD bn

Today, we can certainly argue that Bitcoin & co. have made it to the big international screen and that they are gaining more media traction by the day. In all this buzz, an actual understanding of what a cryptocurrency is, may somehow be neglected. So what we asked ourselves (and what we want to shed light on in this blog) are the following key questions: What is a cryptocurrency and how does its underlying technology, Blockchain, work? What is so revolutionary about it raising investors’ attention globally? How do the main cryptocurrencies differ from each other and what is their designated purposes? Will cryptocurrencies reshape the financial system as we know it?

In order to understand the concept of cryptocurrencies, we will need to analyse its fundamental technology first: Blockchain.

Fundamentals: Blockchain

History lesson on blockchain’s invention

On January 10th 2009, Hal Finney, a man from Santa Barbara received an email from a person, under the pseudonym of Satoshi Nakamoto, with the subject of Crash in Bitcoin 0.1.0 saying the following:

“Normally, I would keep this symbols in, but they increased the size of the EXE from 6.5MB to 50MB so I just couldn´t justify not stripping them. I guess I made the wrong decision, at least for this early version. I´m kind of surprised there was a crash, I have tested heavily and haven’t had an outright exception for a while. Come to think of it, there isn´t even an exception print at the end of the degub.log. I´ve been testing on XP SP2, maybe SP3 is something.

I have attached bitcoin.exe with symbols. (gcc symbols for gdb. If you´re using MSVCI can send you an MSVC build with symbols)

Thanks for your help!”

In the next few months to come, the Blockchain technology was mainly developed alongside the first ever created cryptocurrency, Bitcoin. Therefore, at the beginning, there was not much of a distinction between both, which led to the use of both terms interchangeably. As the technology matured, a large variety of blockchain projects emerged and their applications rapidly diverged from merely the monetary aspect. Overtime, since the first blockchain model arose, several experiments have been conducted to apply its revolutionary technology across many industries such as the automotive sector to the healthcare sector and even to voting systems. Many of the initial ideas and experiments ended up failing while others have managed to successfully test blockchain’s limits, leverage its’ benefits and to sustain substantial growth.

So… what is blockchain and how does it work?

This email marked the starting point of one of the internet’s most revolutionary inventions to date: Satoshi Nakamoto - either a person or a group of people whose identity hasn’t been discovered yet - had written history as the founder and inventor of Bitcoin and its underlying and breaking-through technology, blockchain, by sharing the code and the white paper of his invention for the first time with the “community”, by that time only consisting of Hal Finney and a few others. While only very few people believed in Bitcoin and the blockchain technology in the early days, the community grew steadily and eventually it got to a point of rapid growth thanks to an online drug market which was operating in the Dark Web called Silk Road and which used Bitcoin as a primary platform currency. [2,6]

Having achieved a critical level of attraction, Satoshi Nakamoto vanished from the Bitcoin (and at that time the core Blockchain) community with a final email on April 23rd 2011:

“I’ve moved on to other things. It’s in good hands with Gavin and everyone.”

In the next few months to come, the Blockchain technology was mainly developed alongside the first ever created cryptocurrency, Bitcoin. Therefore, at the beginning, there was not much of a distinction between both, which led to the use of both terms interchangeably. As the technology matured, a large variety of blockchain projects emerged and their applications rapidly diverged from merely the monetary aspect. Overtime, since the first blockchain model arose, several experiments have been conducted to apply its revolutionary technology across many industries such as the automotive sector to the healthcare sector and even to voting systems. Many of the initial ideas and experiments ended up failing while others have managed to successfully test blockchain’s limits, leverage its’ benefits and to sustain substantial growth.

So… what is blockchain and how does it work?

According to Fintechweekly, a “blockchain is a permissionless distributed database [...] that maintains a continuously growing list of transactional data records hardened against tampering and revision, even by operators of the data store's nodes. [...] Each blockchain record is enforced cryptographically and hosted on machines working as data store nodes.”

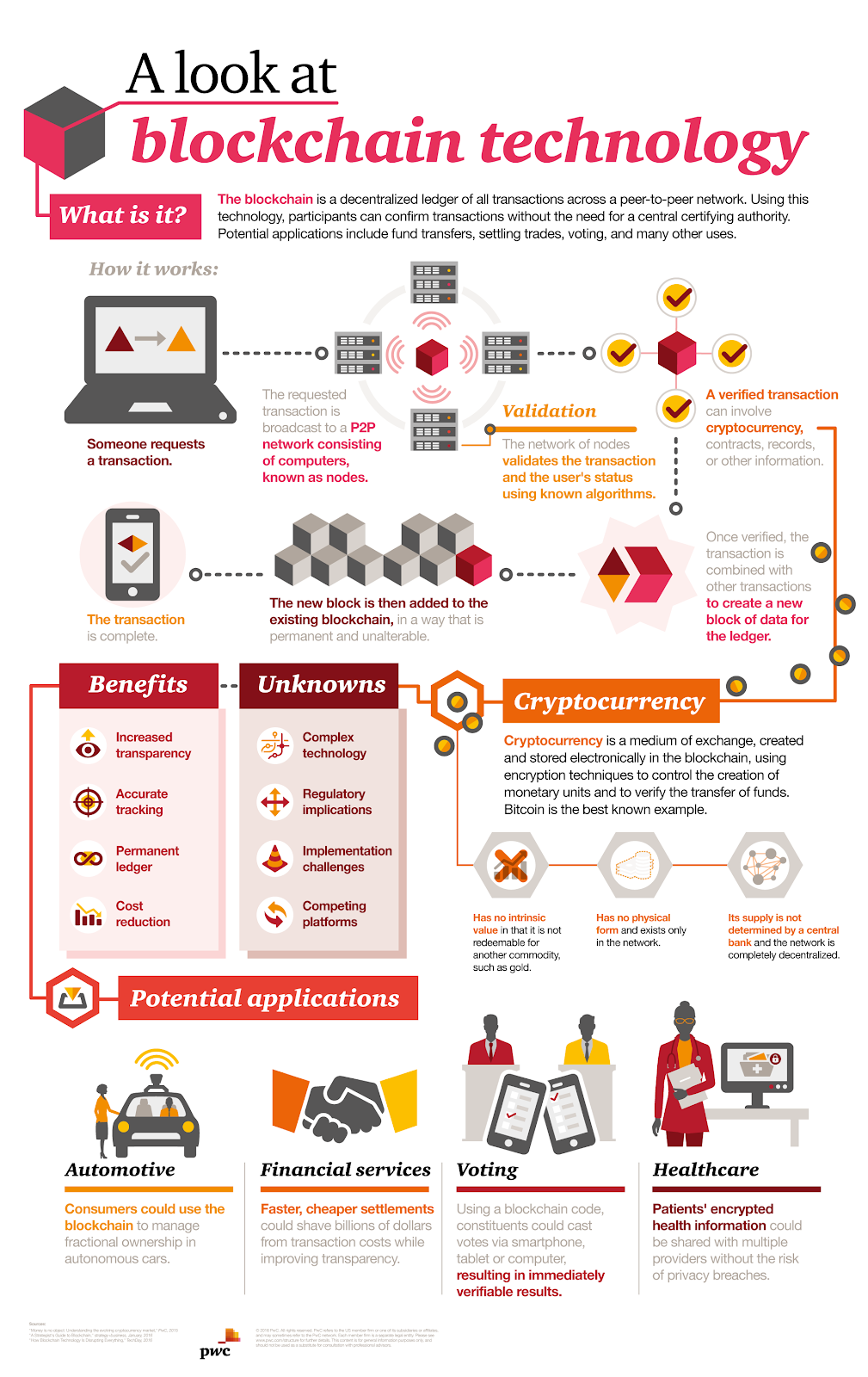

As this definition and all its tech-terms aren’t easy to digest, we would like to demonstrate blockchain mechanics in a clear and concise illustration published by PwC:

Figure 2: Blockchain mechanics

The quality of Blockchain lays in its specific manner on how it stores and transfers data, primarily transaction data. Each block acts as a data storage unit and each unbreakable chain connects all individual blocks (“storing units”). A block, like a table in databases, stores a series of transactions. Meanwhile, the connecting chain secures a deadlock between two subsequent blocks. Each deadlock serves as an element to ensure that all transactions are legit. The blockchain’s size increases with each block added to the chain, with every transaction as a verified element of the chain. Blockchain technology is a concept of decentralized authority and runs on a Peer-to-Peer (P2P) mechanism. This means, that an exact copy of the most current version of the blockchain is stored on each computer that is participating in the network. This concept has enormous security advantages which is one of the main reasons why it outshines traditional databases.

Let’s say, a participating party is requesting a transaction on the blockchain, this would end up in adding a new block to the chain. The system’s first, verifying step is to detect if the locally stored blockchain is indeed the most current and verified chain by comparing the local chain to other P2P chains in the network. One of the most popular techniques for verifying potential transactions is ‘Multi-signature’. The idea is that each transaction must obtain approvals from at least three out of five validators. If that is the case and the validation is successful, the system adds the new transaction as a verified block to the chain and distributes the new chain to all participants in the network. However, if the chain is corrupted the system will detect the flaw and the transaction will not take place.

There are four types of participants in each blockchain network each having varying levels of authorization and dedicated purposes:

Verified users. Only users with permissions can participate in transactions with other qualified users within the same blockchain. Verified users can only make transactions, while the technology of verification automatically operates in the background. Other users cannot view the details of the transaction between user A and user B.

Regulators. A group of regulators focuses on overseeing the transactions conducting between different users. They approve and validate transactions.

Programmers. Programmers create the platform for trusted users to make transactions.

Operators. Operators have the highest authority on the blockchain network, such as monitoring, altering and generating the entire blockchain network.

Back to cryptocurrency

Having discussed and understood the basics of blockchain technology, we can now close the loop by coming back to our core topic cryptocurrency. We will answer all of our aforementioned questions about the concept in a structured and understandable way. Our next blog posts will cover a characterization of cryptocurrencies and their mechanics. We will point out differences between traditional (“fiat”) money and cryptocurrencies, analyse the market and its accessibility. In the next step, we will dive deeper into the cryptocurrency world by exploring specific cryptocurrencies (especially Bitcoin, Ethereum and Ripple) and their distinct purposes. Among many more topics that we will highlight in this process, security will be featured extensively on our blog before we eventually give an outlook towards how we see the future of cryptocurrencies and their impact on the financial world.

Comments

Post a Comment